Your Gateway to Estes Park’s Wonders

Discover Estes Park’s hidden gems! Whether you’re a local or tourist, find insider tips on local eateries, community events, real estate insights, travel guides, scenic routes, and must-see attractions.

A BIT ABOUT ESTESPARK.COM

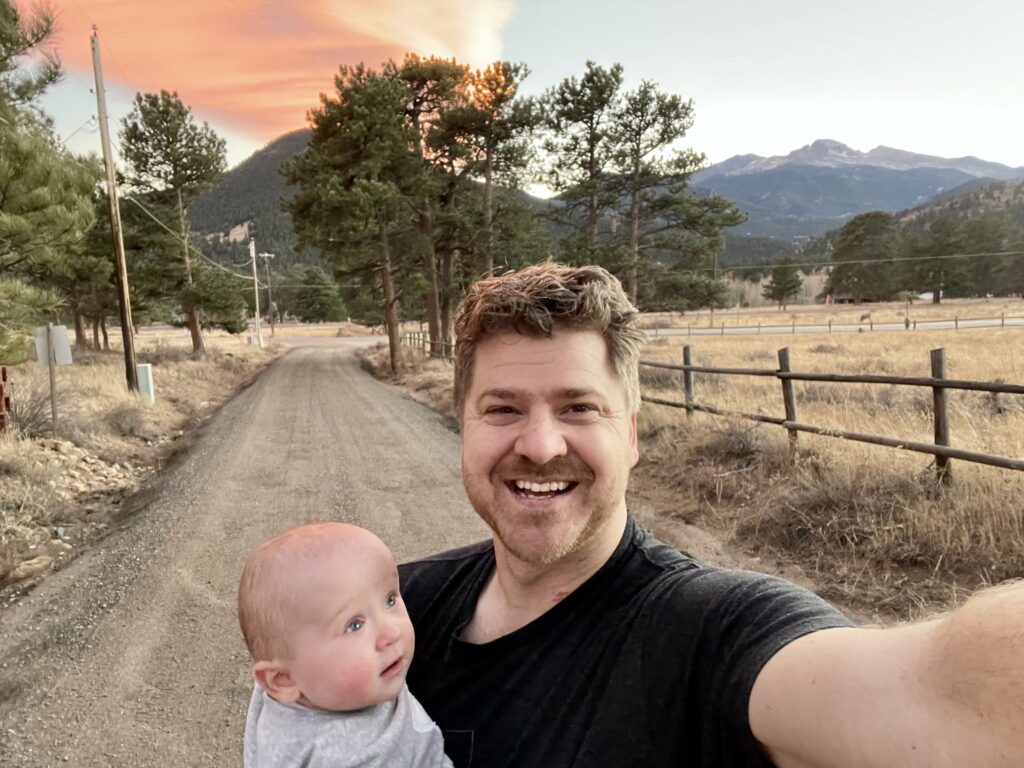

Hello, fellow adventurers! I’m Pep Dekker, your guide to the captivating world of Estes Park, a mountain town nestled in the heart of the Rockies. With my family by my side, including my wife, a dedicated family medicine physician in town, I’ve been privileged to call this enchanting place home for the past three years. Estes Park is more than just a destination for us; it’s where our hearts find solace amidst nature’s grandeur.

Delight your taste buds with Estes Park’s culinary wonders. Indulge in a gastronomic adventure as we unveil the town’s top eateries and hidden gems. From cozy cafes to gourmet restaurants, savor delectable dishes and exquisite drinks that define Estes Park’s rich food scene.

Delight your taste buds with Estes Park’s culinary wonders. Indulge in a gastronomic adventure as we unveil the town’s top eateries and hidden gems. From cozy cafes to gourmet restaurants, savor delectable dishes and exquisite drinks that define Estes Park’s rich food scene.

Discover the heart of Estes Park with our curated list of the town’s most exciting activities. From hiking scenic trails to exploring local art galleries, immerse yourself in the essence of Estes Park’s vibrant culture and natural beauty.

Immerse yourself in the charm of Estes Park’s real estate offerings. Discover dream homes nestled against the backdrop of Rocky Mountain vistas, cozy cabins by serene lakes, and modern residences in the heart of town. Find your perfect haven amidst Estes Park’s breathtaking landscapes and vibrant community.

Embark on a journey through the wonders of Rocky Mountain National Park. Uncover pristine alpine lakes, hike rugged trails embraced by ancient forests, and witness wildlife thriving in their natural habitats. Experience the park’s awe-inspiring beauty, where every step reveals nature’s grandeur and a deep sense of adventure.

Explore our detailed travel guides for Estes Park. Discover the best times to visit, ideal seasons for wildlife sightings, and distances from popular destinations. Plan your journey with expert insights, ensuring you make the most of your Estes Park experience. Uncover hidden gems and create unforgettable memories.

events in Estes Park

Take a look at the exciting events happening in Estes Park this week. From live music performances to outdoor adventures, there’s something for everyone to enjoy. Don’t miss out on the fun – plan your itinerary today!

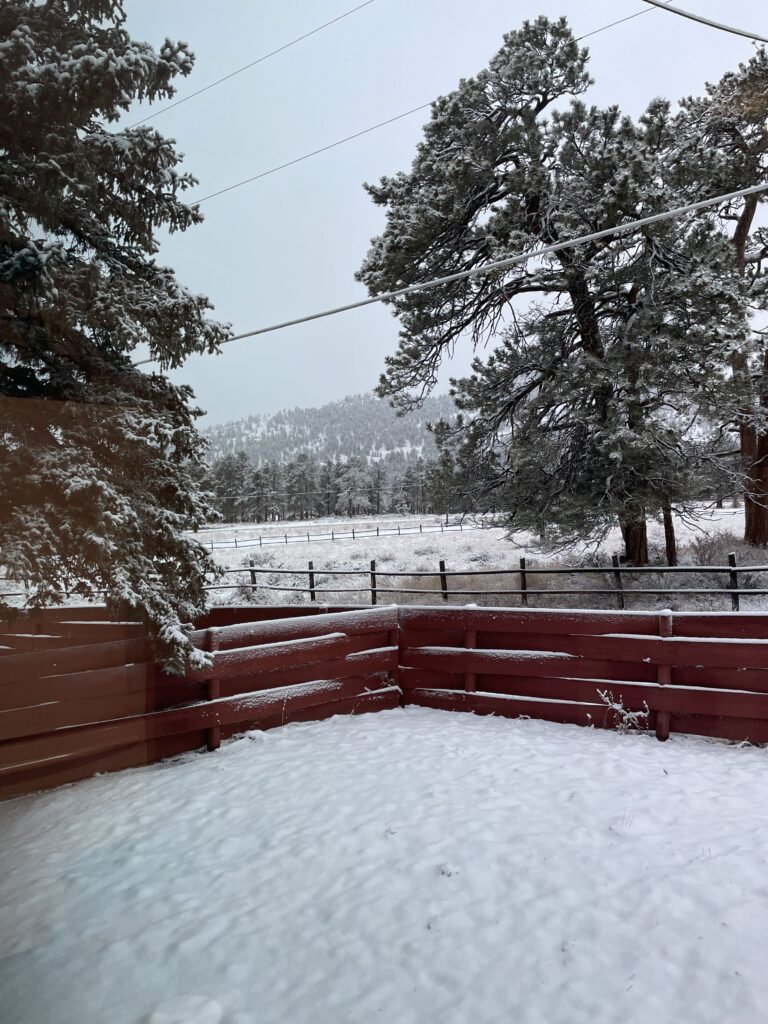

Estes Park Through Our Lens

Embark on a visual odyssey through our curated photo gallery, capturing Estes Park’s essence from a personal viewpoint.